One Of The Best Tips About How To Write A Loan Request Letter

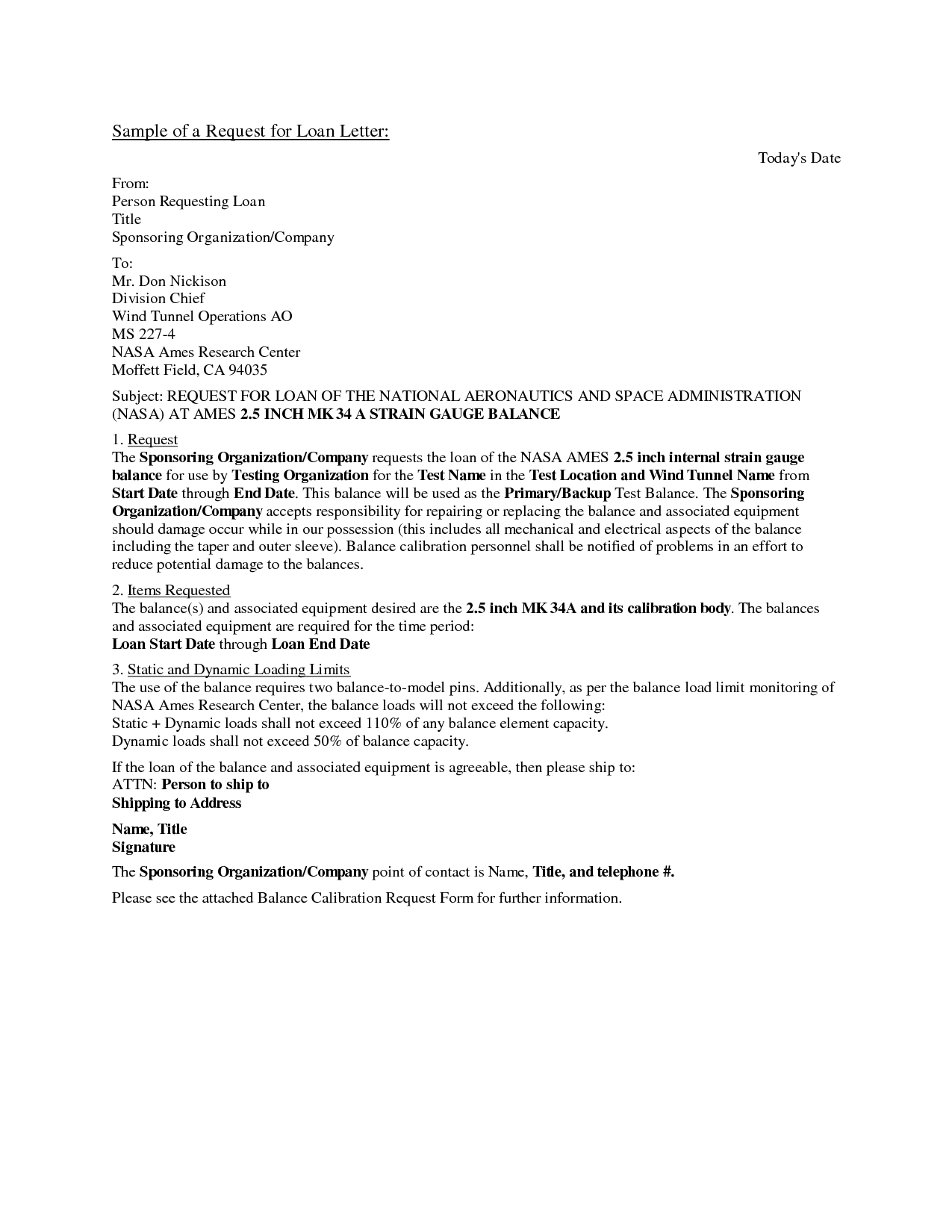

Start with the easy stuff.

How to write a loan request letter. Money lenders and financial institutions do not give out loans to businesses or individuals who walk up their. Begin by introducing yourself and. Learn how to write a.

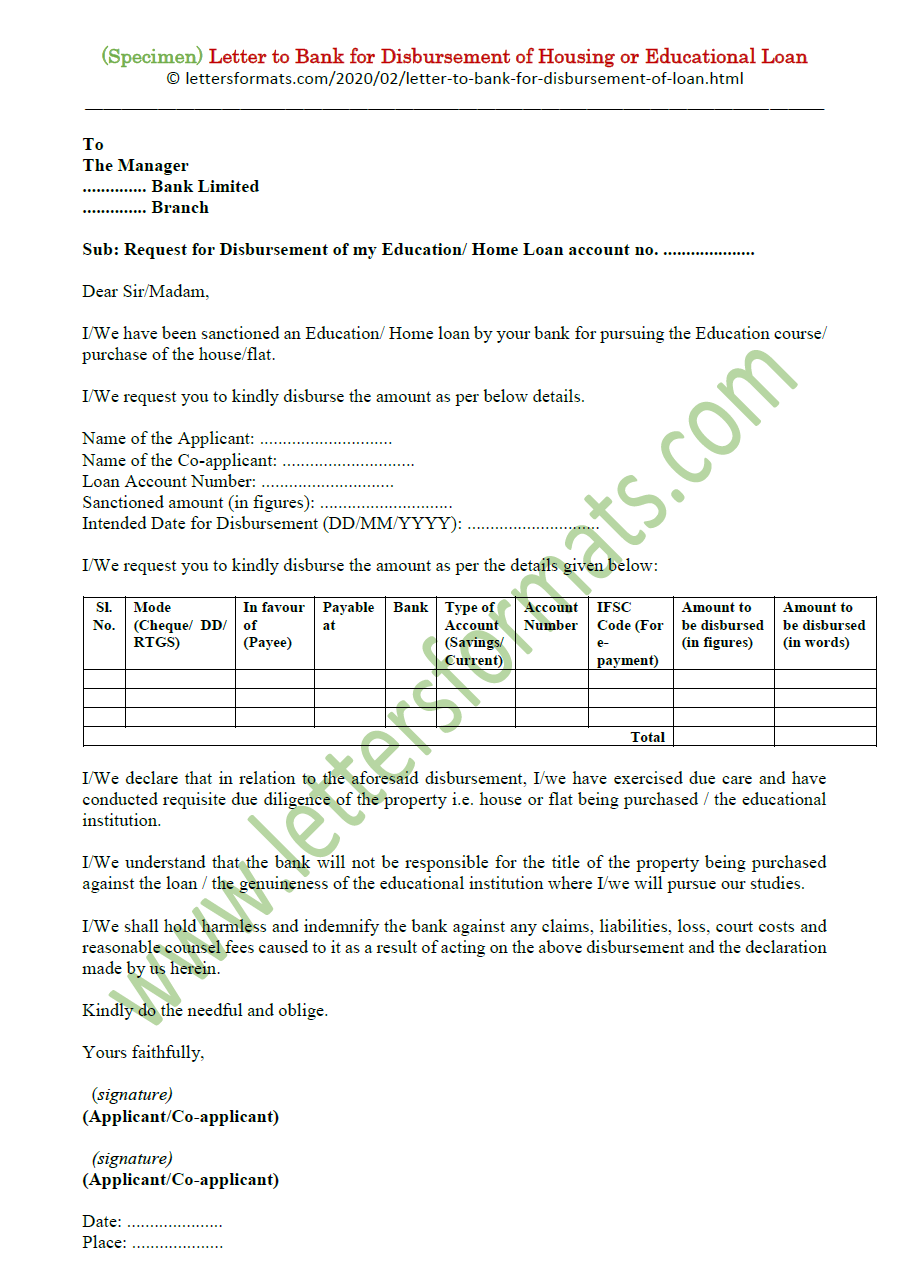

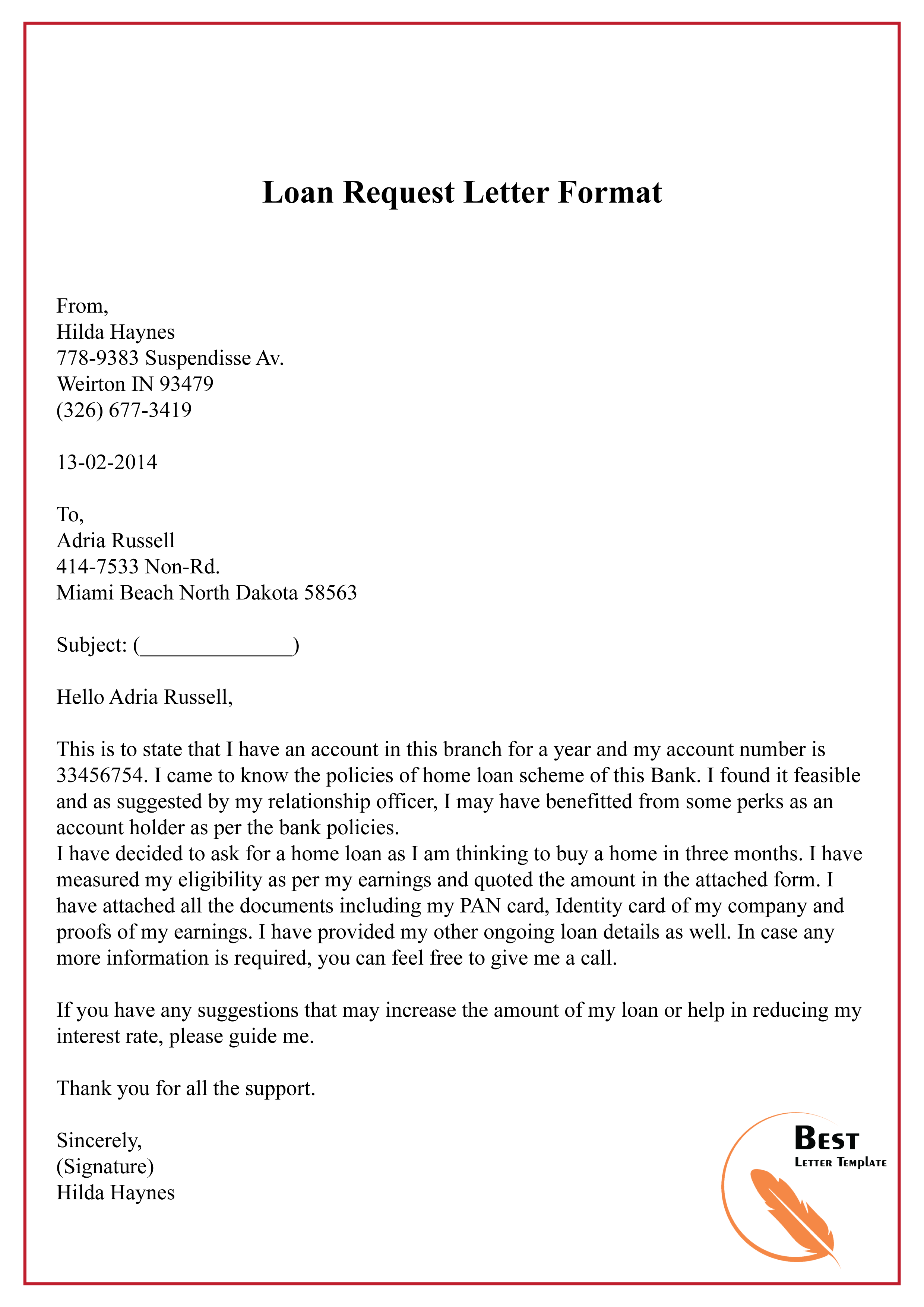

Your loan request letter should include: Most lenders will ask you to submit a loan request letter before committing to providing your business an sba loan. Include your contact information, date, and the lender’s contact details.

The first step to drafting a communicative, informative and persuasive business loan request letter is to begin with. Updated on november 11, 2021. By justin pritchard.

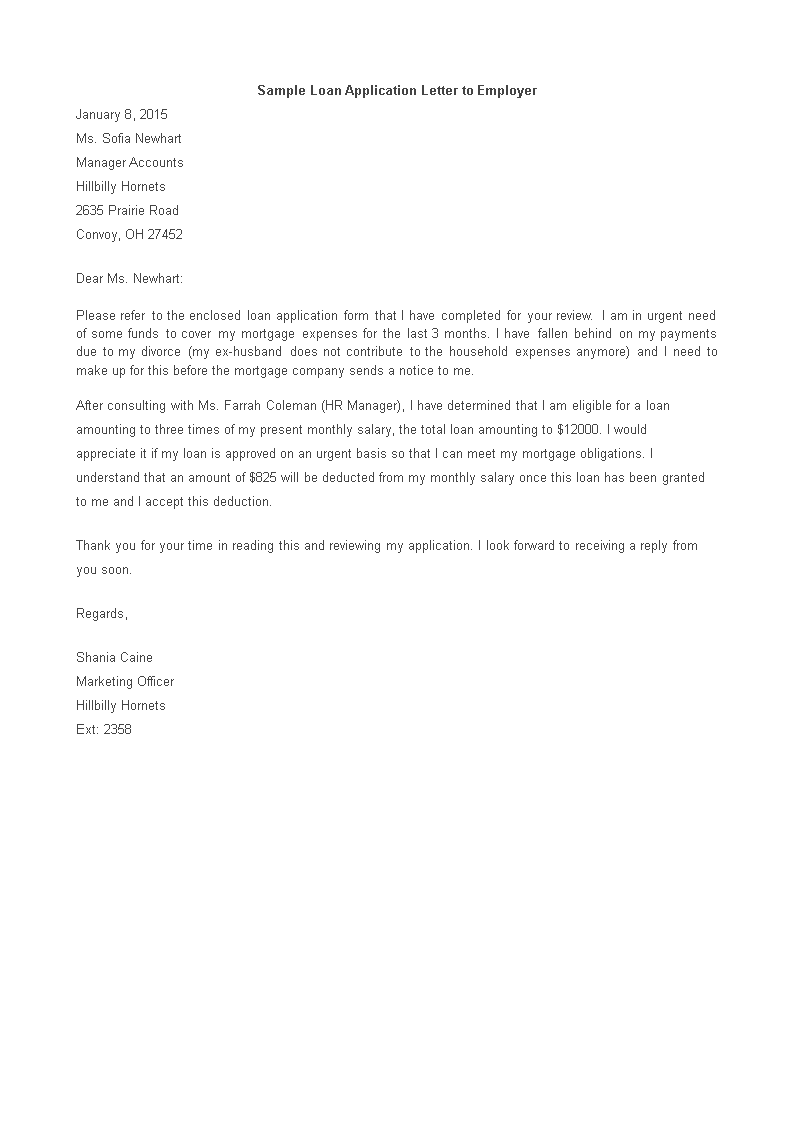

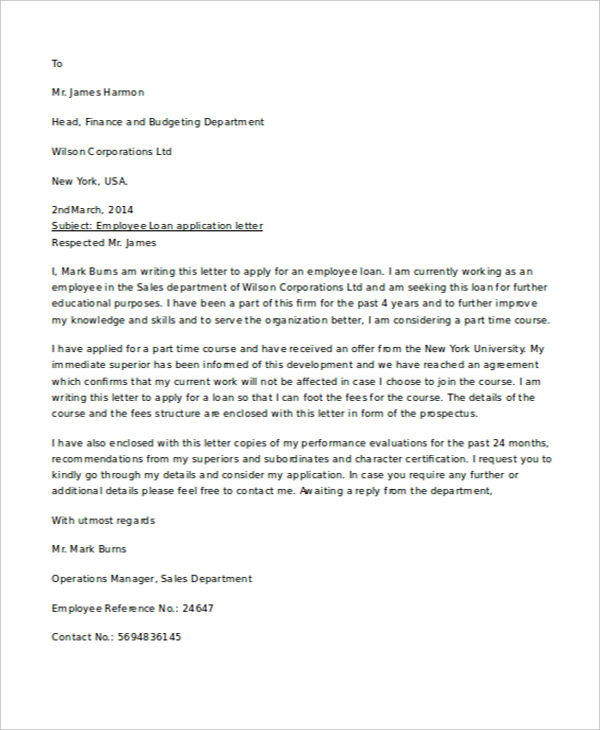

Fact checked by leila najafi. Briefly introduce yourself and your position in the company. This information includes:

How to write a loan request letter: Your occupation or employment status; Add basic information about the business.

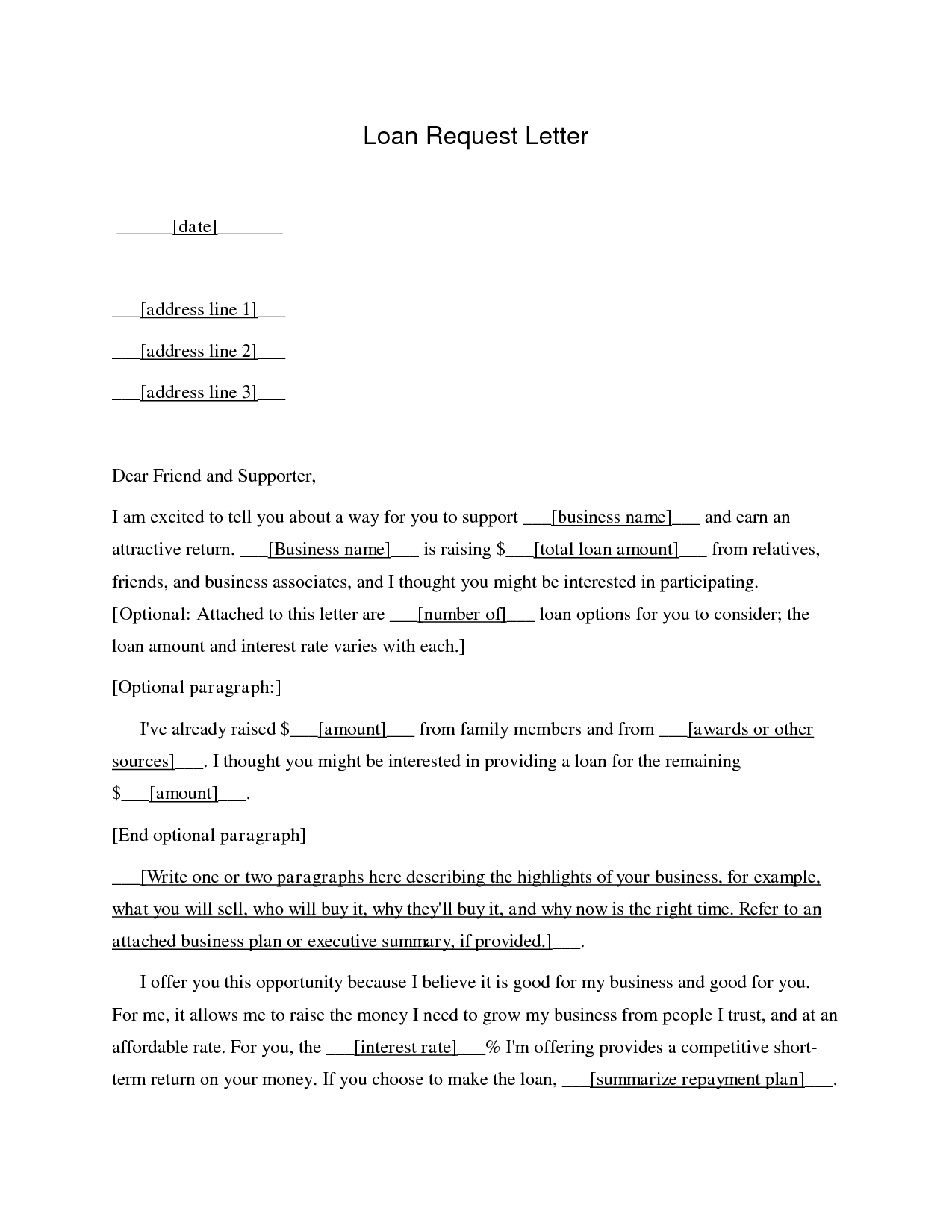

Use a formal business letter format. If you know the name of the loan officer, use it. The first sentence of the loan application letter should state that the applicant wants a loan and the amount of the requested loan.

Start with a formal greeting: How to draft it right! A bank request letter capacity aid your small business secure vital funding.

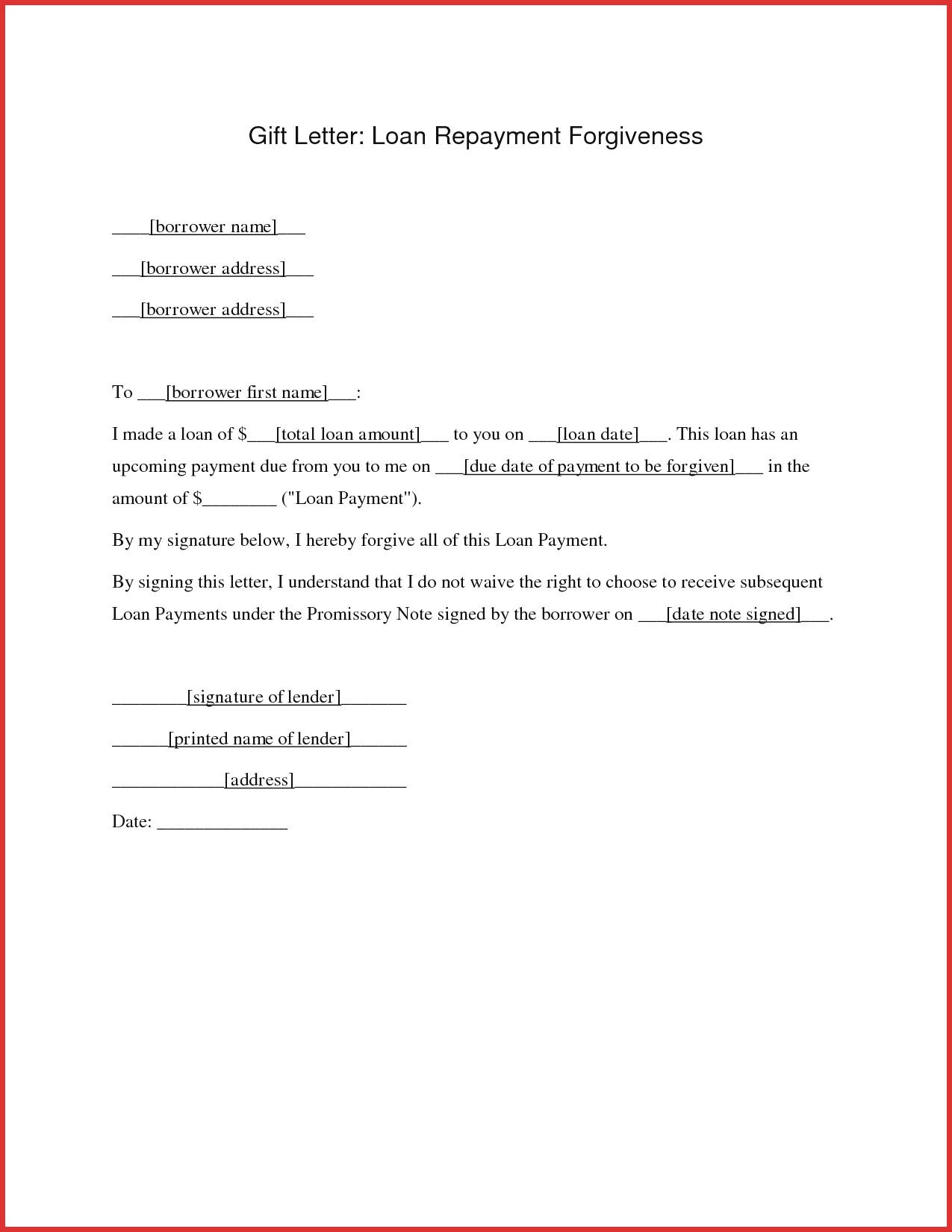

Loan request letters, small business letters / by andre bradley. Loan paid in full letter: Here are specimen, templates and tips on how to write a good one.

If the bank or credit union requests. The top of your letter is reserved for basic identifying information and a subject line that includes your requested loan. Start with a header and a greeting.

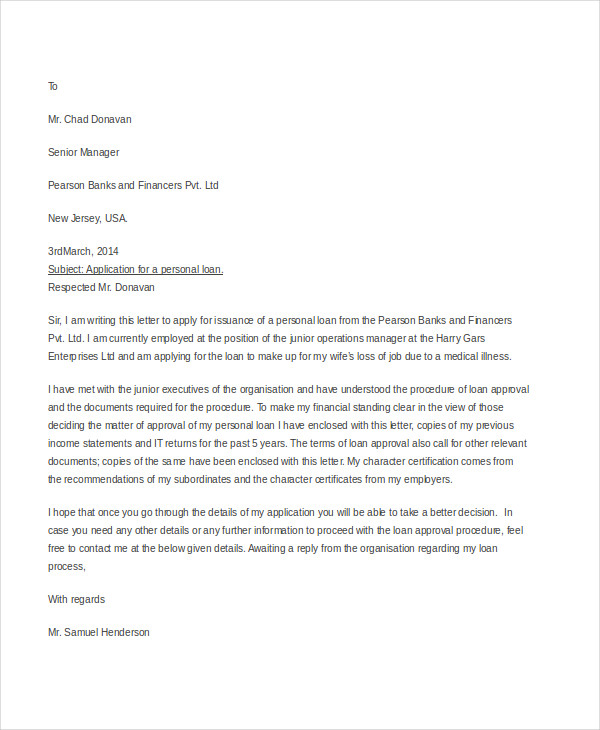

Loan request letters / by andre bradley. A personal loan request letter is a letter written by a loan applicant to a financial institution, introducing themselves and supporting their loan application. Writing a strong bank loan request letter (with samples) use these sample bank loan request letters as templates for your formal loan request letter.