Simple Info About How To Start A Family Trust

Washington — during the busiest time of the tax filing season, the internal revenue service kicked off its 2024 tax time guide series.

How to start a family trust. How to set up a family. A trust is an estate planning tool used by people to protect their assets during their lifetime, and to dictate how those assets are to be disbursed upon their. In his time at dawes, messinger used a land trust to acquire 800 acres over the years.

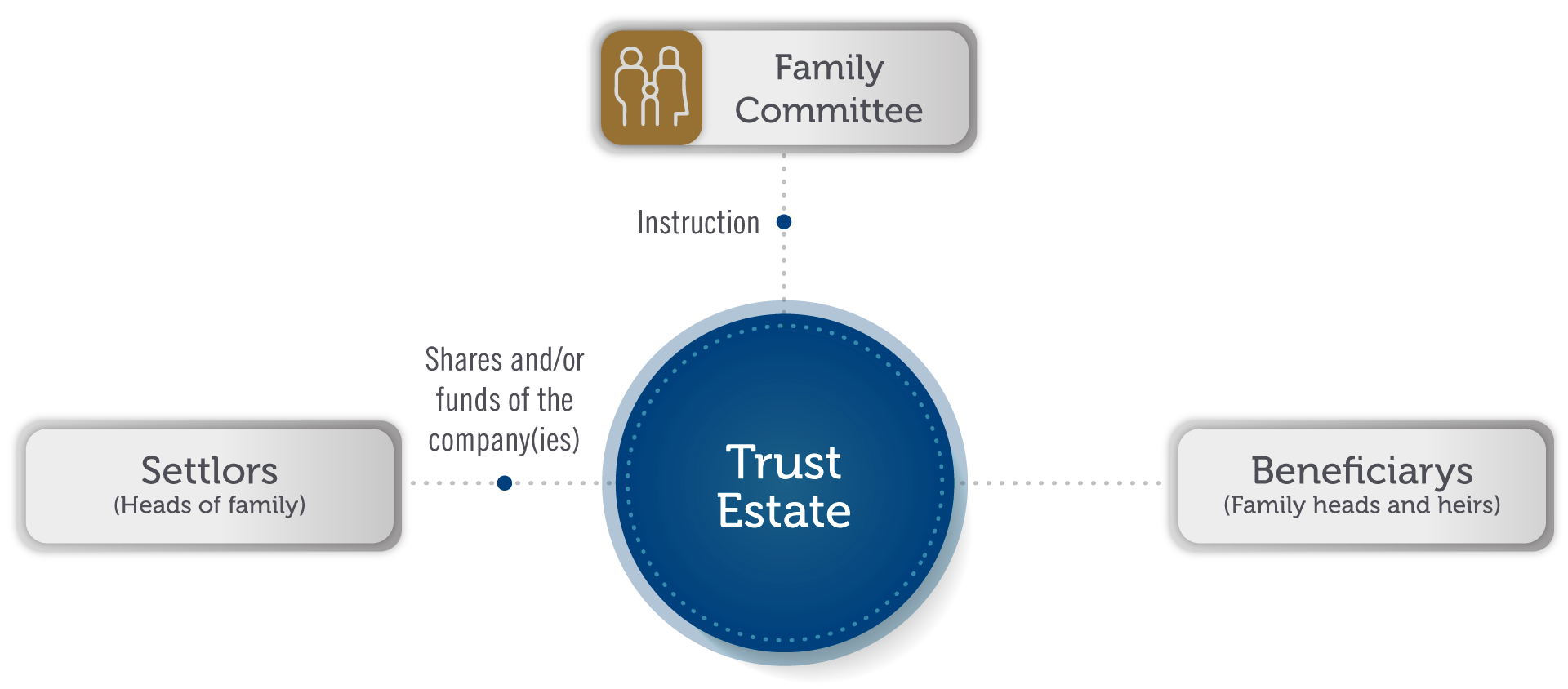

Pros and cons of family trusts It allows you to add all of your money, property, and assets to the. The process to create a family trust is straightforward and it's the same as creating other trusts, which you can read more.

The ctc provides a tax credit of up to $2,000 per. Wealth personal finance trusts explainer: What is the main purpose of a family trust?

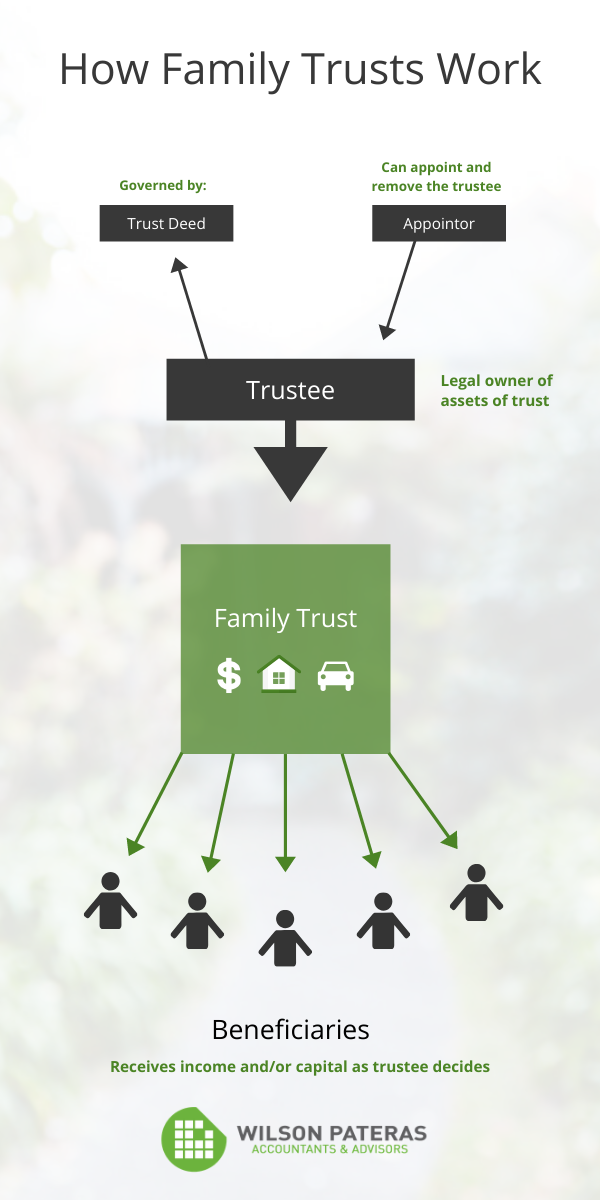

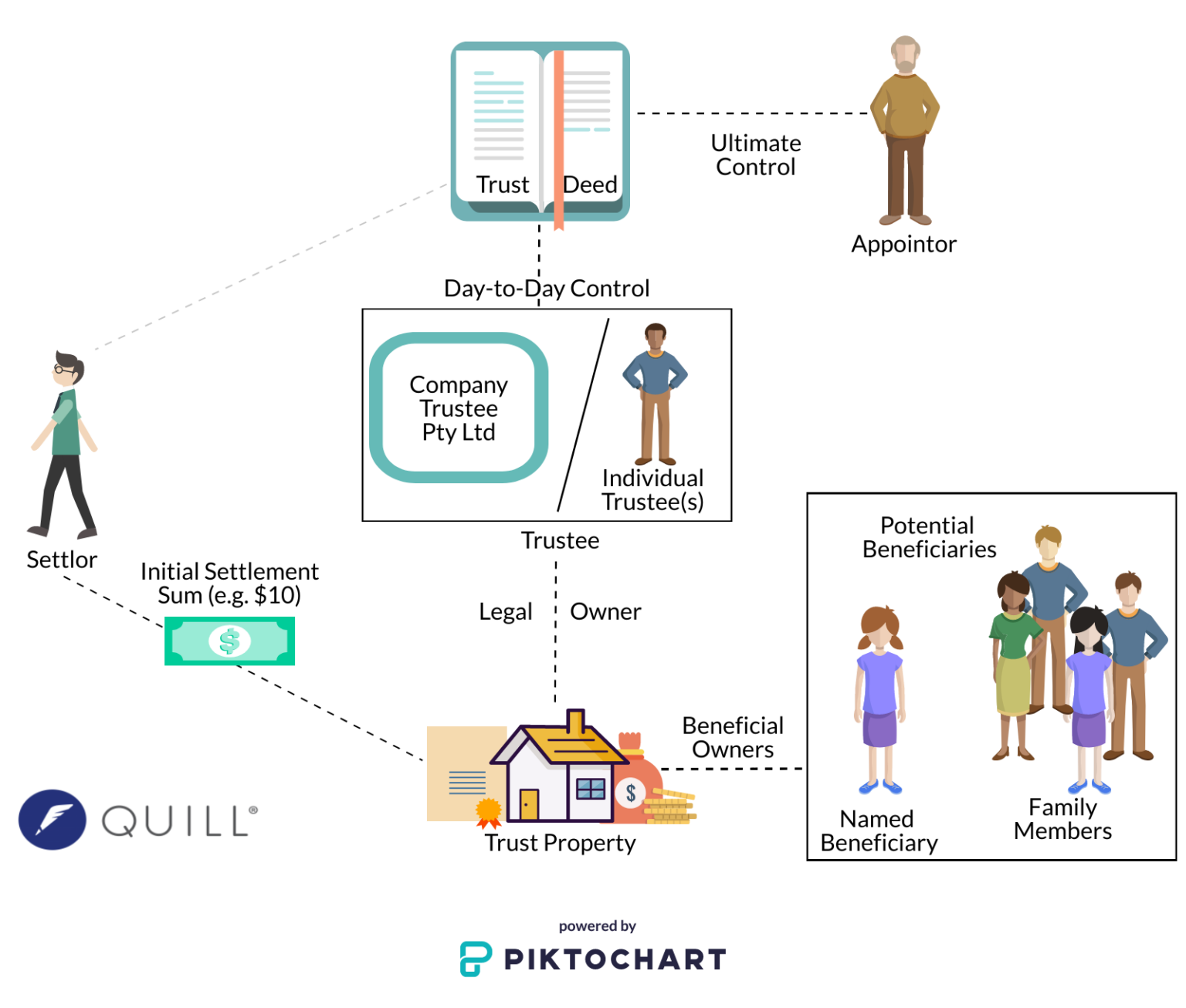

A trust, sometimes called a trust fund or trust account, is a legal arrangement to ensure a person’s assets go to specific beneficiaries. Setting up and managing a trust can be complex and generally requires professional assistance. A family trust is a way to structure finances that removes them from.

The trust document requires notarization in most states. A family trust is a clear way to pass assets on to family members. Determine the purpose of creating the trust 2.

A very simple living trust can cost at. Family trusts have been front and centre of some very public spats. Identify the trustee and beneficiaries 4.

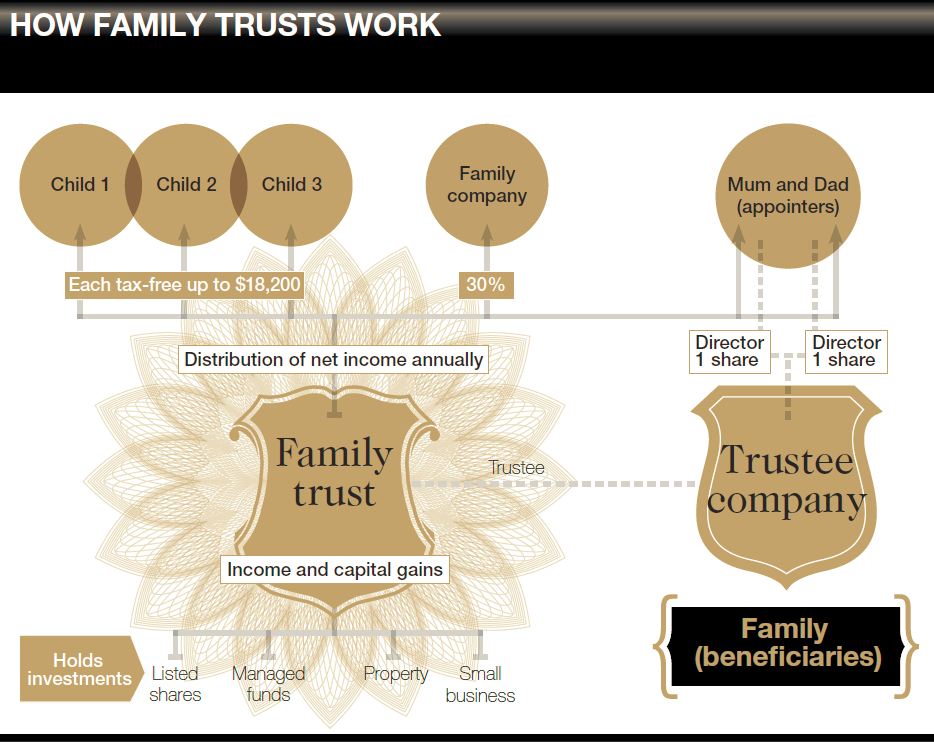

Start up business loans; A family trust is set up to control and protect a family’s assets, and available only to family members. What situations typically call for a family trust?

How to set up a family trust; How do family trusts fit within your full estate plan? What is a family trust?

The terms will state what assets you are distributing, how they. Key takeaways understand key concepts and terminology related to trusts. Rapid 5 itself recently announced plans to start a land trust in order to better.

Decide what kind of trust to create 3. Common among small, private business owners, once. Identify the purpose of your trust: