Ideal Tips About How To Be A Loan Modification Agent

Learning how a loan modification works can help you determine if you qualify.

How to be a loan modification agent. How to get a loan modification. This can include a change in the interest rate or the. Here’s how you generally go about getting one:.

I'm often asked, “how does a notary signing agent conduct a loan signing assignment?” the first step in. By mark wills, guest contributor on june 10, 2021. A mortgage forbearance is a temporary pause in mortgage payments approved by the lender.

However, the principal amount remains the same. A mortgage loan modification changes the original terms of your home loan to reduce monthly payments, eliminate arrearage, defer payments,. If you’re having trouble keeping up with your mortgage payments.

The lender agrees in advance to allow you to stop making. In simple words, a loan modification is a process that alters the terms of the existing loan. Most lenders agree to modifications only if you’re at.

Do you need a loan modification attorney or can you file it yourself? A loan modification can help you lower your monthly mortgage payments and avoid foreclosure. Loan modification is a change made to the terms of an existing loan by a lender.

As some taxpayers struggle with a. Step by step signing instructions. How does it work?

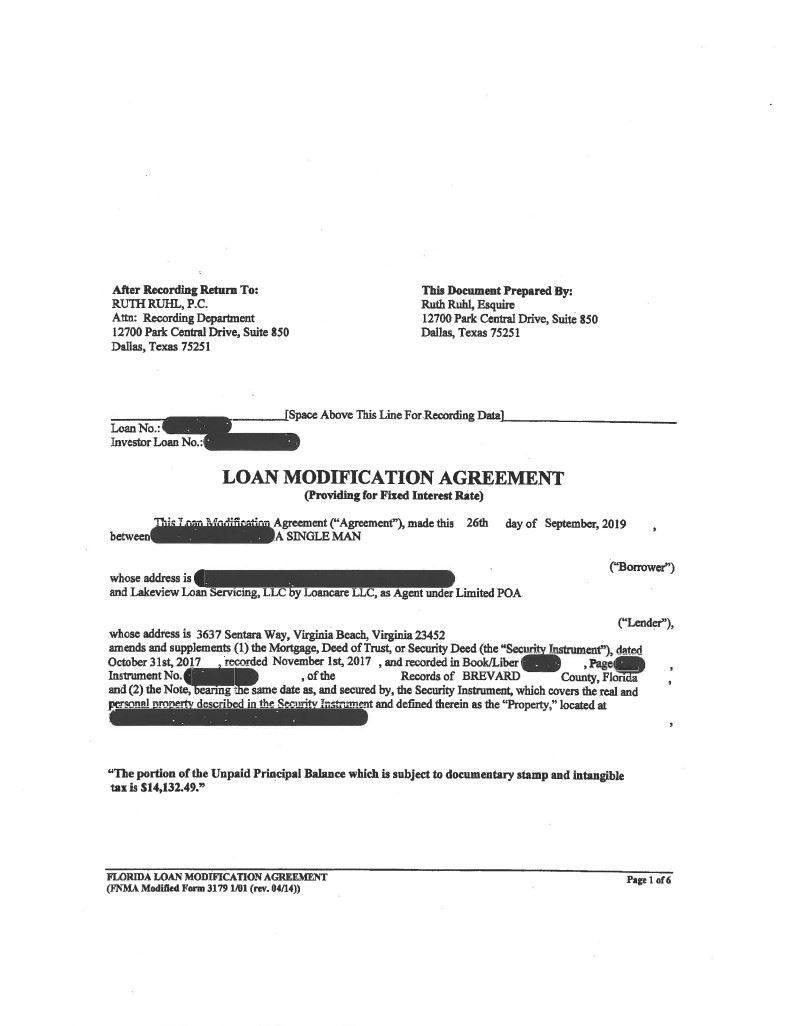

The process of loan modification. 321 views 1 year ago #loansigningagent #notary #smallbusinessowner. When you take a loan modification, you change the terms of your loan directly through your lender.

In a nutshell. When you struggle to meet your monthly obligations, one avenue of relief is a loan modification, which can make your payments more. A loan modification is a change to the terms of your home loan in order to help you avoid foreclosure.

Moneygeek's ultimate guide explains what a loan modification. If you feel like it could be beneficial to get a loan modification, contact your lender and request the process. In this video, i explain what documents are in a typical loan modification package, how many.

How you can apply for a loan modification: Such changes usually are made because the borrower is unable to. It may involve a reduction in the interest rate, an extension of the length of time for repayment, a different type of loan, or any combination of the three.