Formidable Info About How To Apply For Homestead Exemption In Texas

![Texas Homestead Tax Exemption Guide [New for 2024]](https://www.exemptform.com/wp-content/uploads/2022/08/fillable-form-t-1067-request-to-rescind-homestead-exemption-1995.png)

By reviewing your eligibility, staying up to date with tax laws, and filing your taxes, you can maximize your homestead exemption benefits.

How to apply for homestead exemption in texas. Texas has several exemptions from local property tax for which taxpayers may. All homeowners may receive a $100,000 homestead exemption for school taxes. Owned the property on january 1st.

In the event that you do not qualify, you will be notified and offered an opportunity to protest this decision. If you’re wondering how much is the homestead exemption in texas, you should note that a property owner can apply for any one of the following exemptions: Its purpose is to assist in reducing the property tax payable to the.

How do i qualify for a disabled person's exemption? Claim homestead exemption retroactively for the past two years. To see if you qualify or to apply, contact the (name) appraisal district office today.

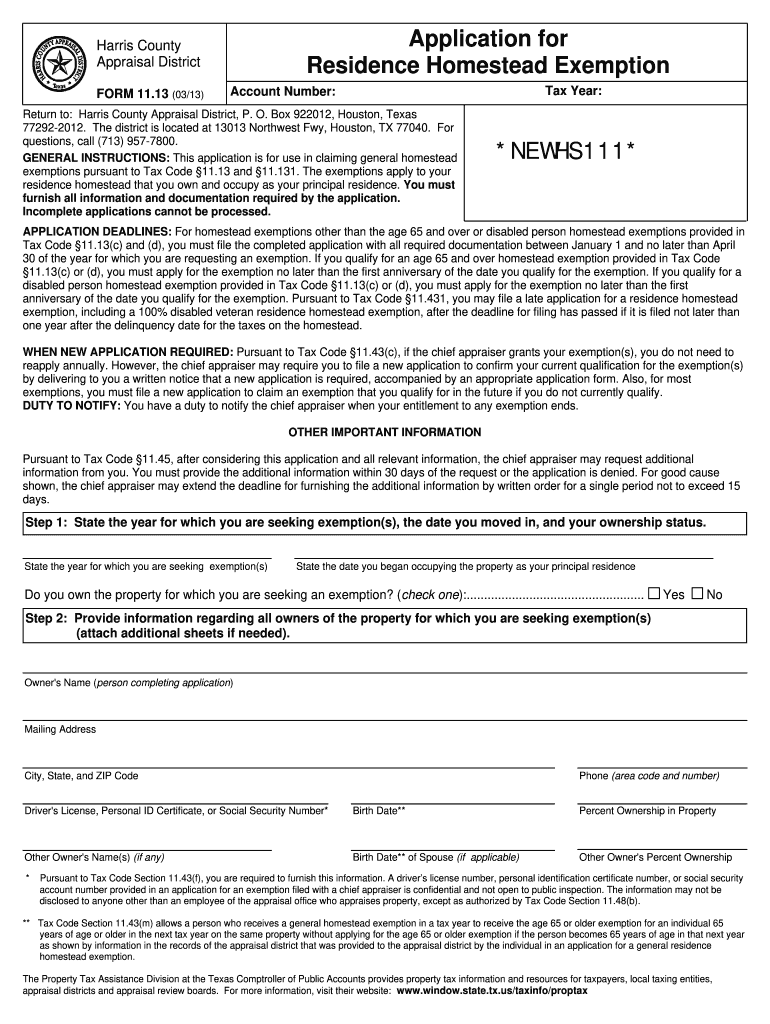

Texas residents are eligible for a standard $100,000 homestead exemption from public school districts as of november 2023, which can be applied for via an application for residential homestead exemption and, once granted, remains in place without needing annual renewal. For the $40,000 general residence homestead exemption, you may submit an application for residential homestead exemption (pdf) and supporting documentation, with the appraisal district where the property is located. Homeowners looking to reduce their property tax bills may find some relief by filing a homestead exemption.

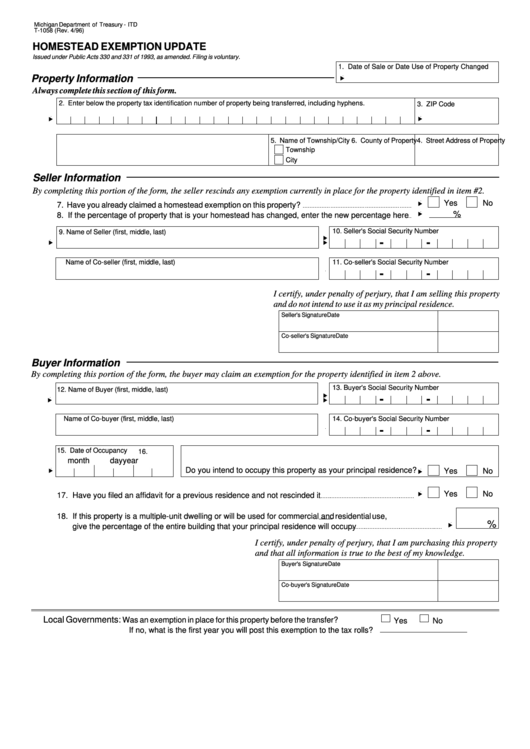

Property owners are allowed a $40,000 exemption on their primary residence. The process for applying for homestead exemptions in texas varies by county, but applicants should begin by visiting the tax appraisal website for your county. Applications for property tax exemptions are filed with appraisal districts.

I just moved in to my new home. Box 600, pleasanton, tx 78064. Action on your application will occur within 90 days from the date it is received.

A homestead is generally the house and land used as the owner’s principal residence. When should i apply for homestead exemption? What residence homestead exemptions are available to persons age 65 or older or disabled?

Do not file this form with the texas comptroller of public accounts. Exemption applications can be submitted by mail, online, or at our office: Owned and occupied the property on january 1 of the year the application is made.

Texas driver's license or texas id card with the same address as the homestead property. Texas homestead exemption applies to a homeowner if they: 1, 2023, the law requires each appraisal district in the state to confirm that the recipients of a homestead exemption still qualify for the exemption at least once every five years.

You will need to fill out an application each year that you want to claim homestead exemptions. This will allow for a qualifying new home to be eligible for a homestead exemption from the date of purchase. If a homeowner has received a letter asking for confirmation, then that homeowner will have to complete an enclosed application and submit the.

:max_bytes(150000):strip_icc()/homestead-exemption-Final-be3088c622ec4605af6ec6729321c546.jpg)

![Texas Homestead Tax Exemption Guide [New for 2024]](https://assets.site-static.com/userFiles/3705/image/texas-homestead-exemptions.jpg)